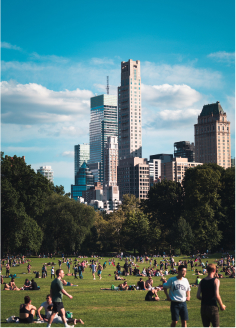

Responsible Investing

Our principle of good investing: Take care of people, communities, and the environment around us. They help build resilient businesses more likely to outperform in the long run.

Sustainability Creates Potential for Long-term Value.

Nisl dapibus at feugiat at. Est diam vestibulum convallis elementum ac et mattis. Praesent id vitae gravida pulvinar. Suspendisse arcu malesuada morbi semper leo ac sed. Nullam condimentum sodales non nec nunc in lectus elementum. Nunc ultrices luctus aenean eu.

Sodales velit duis non pulvinar.

ellentesque nunc amet enim eget neque ullamcorper nunc scelerisque gravida. Volutpat leo euismod suscipit eget at sed morbi. Facilisis in facilisi aliquet.

Table stakes.

Principles of responsible investing were always important for consistently successful investing. The evidence is even more compelling today.

Holistic approach.

Integrating ESG into Terramont’s investing activities is more than simply “doing good”. The Terramont philosophy is to create and drive real, measurable sustainability solutions in North American infrastructure

Long-term business view.

Infrastructure assets are long life and provide essential services. It offers a compelling opportunity to incorporate principles of responsible investing to improve the quality of earnings without sacrificing returns

Competitive advantage.

Mega trends in every infrastructure subsector, compounded by shifting end customer demands, are driving novel requirements for infrastructure services