Strategy

Differentiated approach to value creation

Overview

Terramont is a North American-focused infrastructure investment manager investing in middle market businesses in renewables, power & energy, transportation, environment, digital and social infrastructure

Enim massa aliquet odio fermentum in nunc cursus volutpat. Sed malesuada consequat fermentum nibh dignissim sed.

Diam velit massa placerat lorem. A eu nunc elit lectus urna duis fames in nulla. Convallis egestas diam pellentesque tincidunt aliquet orci. Aliquet metus neque sed tellus nullam ac et aliquam sagittis.

Sit eget risus quis id tortor. Pulvinar nulla at tempus proin mi urna diam nullam. Gravida potenti sit neque sagittis massa quam faucibus egestas. Cum vel lectus in eu consectetur donec. Odio aliquam in commodo accumsan nisl lorem id sed. Ullamcorper non at ornare enim.

Sit fringilla at nec pretium augue justo. A in dignissim pellentesque nulla at at. Lorem at duis eget pellentesque elit amet nibh vulputate fermentum. Tellus felis nisi cursus vestibulum pellentesque sit erat quam diam. Massa cras quis purus ipsum.

Sit fringilla at nec pretium augue justo. A in dignissim pellentesque nulla at at. Lorem at duis eget pellentesque elit amet nibh vulputate fermentum. Tellus felis nisi cursus vestibulum pellentesque sit erat quam diam. Massa cras quis purus ipsum.

Investment Strategy.

Strategy leverages deep investment experience in adding value to middle market infrastructure assets

Infrastructure

Investments in asset-based businesses with regulated or natural monopolies and business models with sticky competitive advantages, delivering essential services supported by contracted cash flows

Investment Size

$50MM - $250MM1 in equity investment primarily in control positions. Select investments with significant minority interest with strong alignment of interest and adequate governance

Value-add Scope

Breaking traditional infrastructure mold, adding value through enhancements to sustainability, operations, innovation, and technology

Execution

Build middle market infrastructure companies or platforms as an active value-added partner to management, while aiming to make a positive impact on the communities we invest in

Diversified Portfolio

Diversified portfolio construction investing across renewables, power & energy, transportation, environment, digital and social infrastructure

Targeted Infrastructure Sectors

We thematically pursue investment opportunities in the sectors below and accumulate a deep knowledge and expertise to make the best investments

Renewables

Declining cost of renewables expected to support production of green hydrogen, essential for economy-wide decarbonization

Power/Energy

Conventional energy transport and storage infrastructure will gradually be repurposed for carbon-free fuels

Transportation

Sector electrification driven by transportation’s role as the largest source of greenhouse gas emissions in the U.S.

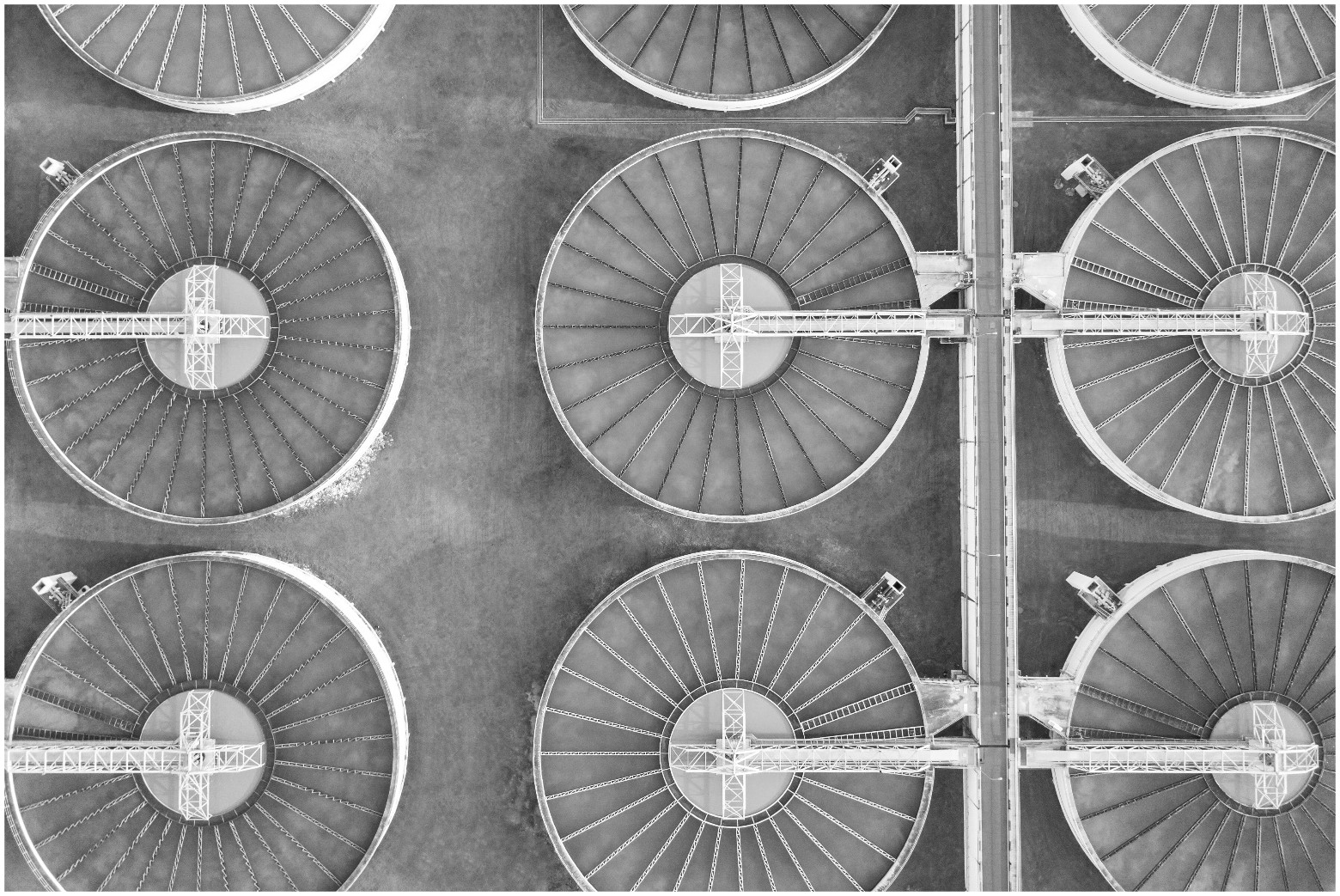

Environment

Declining cost of renewables expected to support production of green hydrogen, essential for economy-wide decarbonization

Social

Declining cost of renewables expected to support production of green hydrogen, essential for economy-wide decarbonization

Digital

Assets supporting the growth in digital connectivity across industrial, commercial, and consumer driven by data transmission capabilities of devices such as vehicles, equipment, and buildings

Four Lenses of the Terramont Value-Add

Four-pronged approach to identify end-to-end value creation from operator to end customer